As unique educational institutions, charter schools serve as pillars in their respective communities.

Through our extensive experience working with K-12 charter schools and their partners, our team understands what it takes to run a successful school while adapting and growing when necessary to meet the needs of their students. NFF’s team does not stop at lending experience – we also have former charter leaders, instructors, policy makers, and legal experts all versed in the charter school landscape. Our expertise in charter schools’ underlying business models and unique financial drivers allows us to provide truly customized support and flexible terms for each of our clients.

Inquire today to learn about NFF’s favorable loan terms, including very flexible loan-to-value ratios and extended interest-only periods.

Charter School Financing Options

NFF can service charter schools nationwide! Our lending experience includes, but is not limited to: Alabama, California, Colorado, Florida, Louisiana, Maine, New Jersey, New York and NYC, Pennsylvania, Rhode Island, Tennessee, Texas, Washington, and Puerto Rico.

Facility Loans

- Acquisition of new charter school facilities

- Pre-development and/or project-related soft costs

- Expansion of existing buildings

- Construction, renovation, and leasehold improvement

- Long-term permanent financing

Equipment Loans

- Furniture, fixtures, and equipment

- Playground equipment, walls, and fencing

- Green and energy efficiency improvements

Working Capital and Bridge Loans

In addition to charter school facilities lending, NFF offers working capital lines of credit to smooth irregular, episodic funding streams.

New Markets Tax Credits (NMTC)

NMTC can bring much-needed equity to charter schools. NFF has leveraged millions of dollars in tax credits to spur investment in projects in low-income communities.

Insights

News

January 22, 2026

Level Field Facilities Fund and NFF Partner to Expand Equitable, Early-Stage School Facilities Financing

Story

October 6, 2025

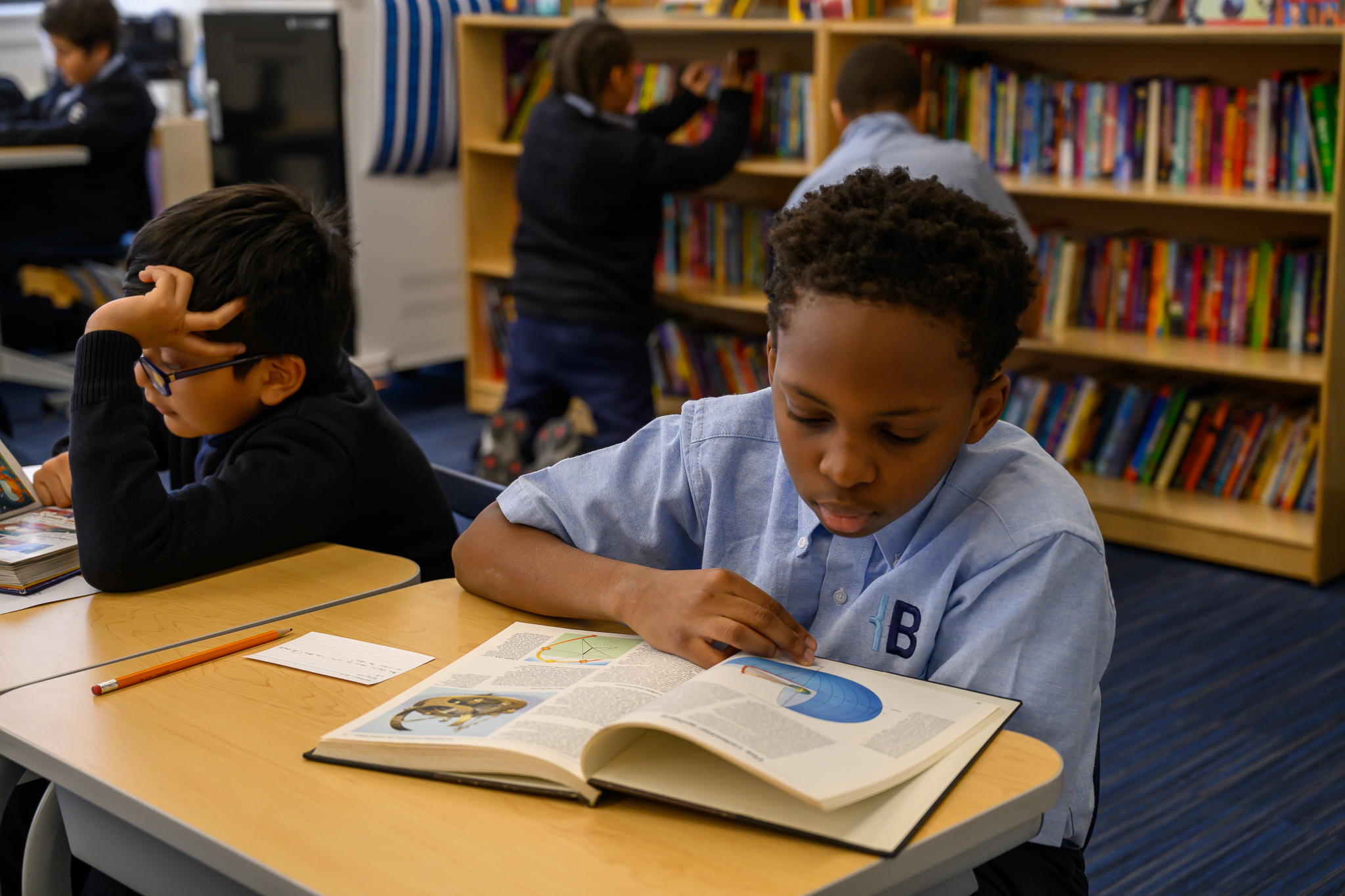

Bold Charter School

Story

October 3, 2025

Carmen Schools of Science and Technology

Blog

May 28, 2025