Budgeting for Restrictions

Budgeting for Restrictions

Making Your Budget the Backbone of Your Nonprofit - Part 3

In our last blog on Budgeting Best Practices, we looked at the example of Hope Through Housing (HTH). Founded on the belief that everyone deserves an equitable chance in life, HTH offers food, clothing, mentorship, and job opportunities to young people in Philadelphia. Jordan Johnson, Founder and Executive Director of HTH, continues to explore new ways for HTH to better support youth in actualizing their dreams.

Jordan Johnson submitted her budget to NFF for review and consultation, and I’ll use her example to illustrate how to budget and track restricted as well as “to-be-raised” revenue.

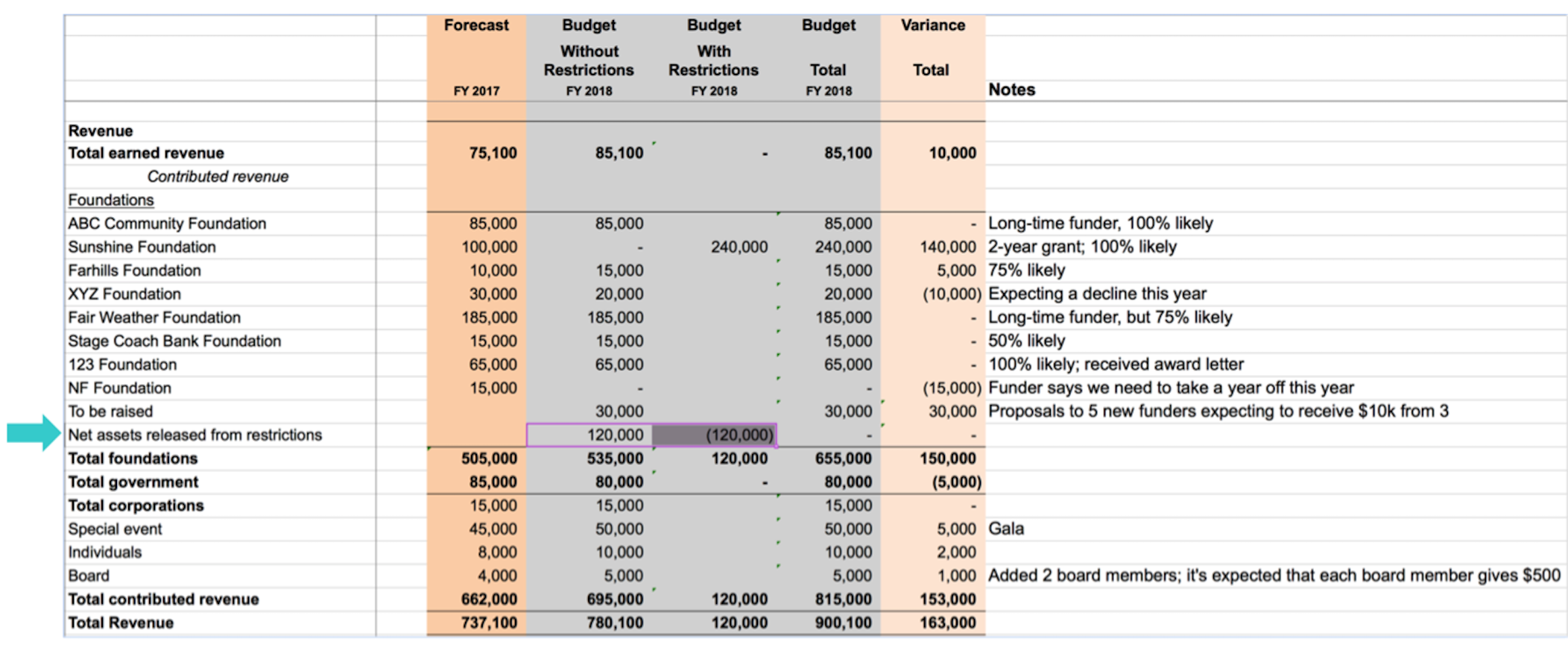

Jordan recently received word that the Sunshine Foundation will be giving the organization a $240,000 grant with the restriction that $120,000 should be spent in fiscal year 2018 and $120,000 should be spent in fiscal 2019. Jordan expects to receive all the funds in cash at the beginning of fiscal year 2018. As such, she has put the entire $240,000 in her 2018 budget (see the Sunshine Foundation line in the chart below). Should she?

Contributed revenue with donor restrictions either has a donor-imposed time frame or purpose for how the grant or donation should be spent. For instance, a donor may give an organization money and restrict its use to support a particular program (like a high school mentorship program), or a foundation may commit to a two-year time-restricted grant, as in our case. The restrictions are released when the time and/or purpose have been met or satisfied. Even if HTH receives the full $240,000 in 2018 in cash, it is important to track the amount intended for use in each year separately, which means capturing $120,000 in the 2018 budget and $120,000 in the 2019 budget.

What to do when you receive contributed revenue with donor restrictions

Take a look at the updated version of HTH’s budget below. I inserted a column to the left of the total budget column and labeled it “Budget With Restrictions.” This is one way that Jordan can keep a record of each grant received with donor restrictions. For the upcoming budget year, she only has one restricted grant, and we recorded the receipt of that $240,000 Sunshine Foundation two-year grant in the Budget With Restrictions column.

I also created a column labeled Budget Without Restrictions. This is the column where Jordan will record all revenue transactions that do not have restrictions.

What to do when restrictions are met or satisfied

According to the provisions of the grant, Jordan can release $120,000 in 2018. As you can see below, in the line labeled “Net assets released from restrictions,” Jordan will record a negative $120,000 in the Budget With Restrictions column. At the same time, she will record a positive $120,000 in the Budget Without Restrictions column so that it can be counted as revenue in the 2018 year. This allows us to see how the donor would like this multi-year grant to be spent.

As a note, HTH will release the remaining restricted $120,000 Sunshine grant in this same way in its 2019 budget. Managing donor restrictions in the budgeting process can be a very common area of confusion for most folks in nonprofit leadership.

So what does this do to HTH’s projected surplus for the year? While the total surplus does not change (see the $160,467 surplus below in the total budget column), this updated presentation makes clear the amount of resources available for use in the 2018 budget year. The organization is now projecting a $40,467 unrestricted surplus (see the Budget Without Restrictions column in the chart below). Less exciting than $160,467, of course, but more accurate.

To-be-raised revenue

To-be-raised revenue are funds that are anticipated as a result of future fundraising/development efforts. Should to-be-raised revenue be included in your budget? The answer is: it depends. Let’s look at the HTH budget. In the notes column, Jordan states that she is expecting to send out proposals to five new funder prospects and is hoping to receive a total of $30,000 from three of the five.

I like her thinking, but I would ask her a few questions to justify the entry:

- Do you feel like you have untapped funders in your community? And if there aren’t potential new donors, where will these prospects come from?

- Where are you in the process (i.e., Have you identified any of these prospects?)?

- If prospects have been identified, do you know each of the funders? Is there a relationship with any of them?

The reason I ask these questions is to make sure that Jordan is not inadvertently using to-be-raised revenue to plug a hole in the budget. Some organizations may feel obligated to present a “breakeven” budget to their board to avoid showing a deficit. The risk is that the board may gloss over the to-be-raised category and approve a breakeven budget. I would encourage these organizations to show their finance committee a deficit budget so that they can have a practical and more intentional conversation about how to balance the budget. These conversations allow leadership to better understand the internal capabilities of the organization in the context of the external environment in which they operate.;

So, Jordan reworked her budget, and then asked the following questions: “How are we going to build reserves for the future? Can we do this via the annual budgeting process?”

Next up: Below-the-Line Budgeting

Important note about net assets with donor restrictions: Financial Accounting Standards Board (FASB) has issued changes to its nonprofit accounting standards that are intended to simplify how a nonprofit organization classifies its net assets (among other changes). While nonprofit budgets are not subject to these standards, for purposes of consistency we adopted the new language for this blog series. The changes will go into effect as soon as next year for some organizations. At that time, contributed revenue — such as donations, contributions, and grants — will either be categorized as contributed revenue with or without restrictions, as opposed to the three current categories, unrestricted, temporarily restricted, and permanently restricted. For the details on these changes and others, FASB will be hosting a webinar on the topic.

For more on this topic, read Four key facts about the New FASB Not-for-Profit Standard.

Join over 24,000 social sector leaders who receive our latest insights and noteworthy stories throughout the year.